Sparkling Wine Importing Countries Top 10 – Q1 2023

3rd October 2023

As part of our continuing series of articles for glassofbubbly.com, focused on the international trade of sparkling wines, OENsights.com (pronounced exactly like ‘insights) has prepared an overview of the key Sparkling Wine International Trade trends, during the first quarter of 2023.

This time we’re taking a glimpse at the global wine imports figures – as reported by the importing countries. Our analysis is based on preliminary data on the total value of imported wine – since complete facts, about the total quantities, are still unavailable for 2023.

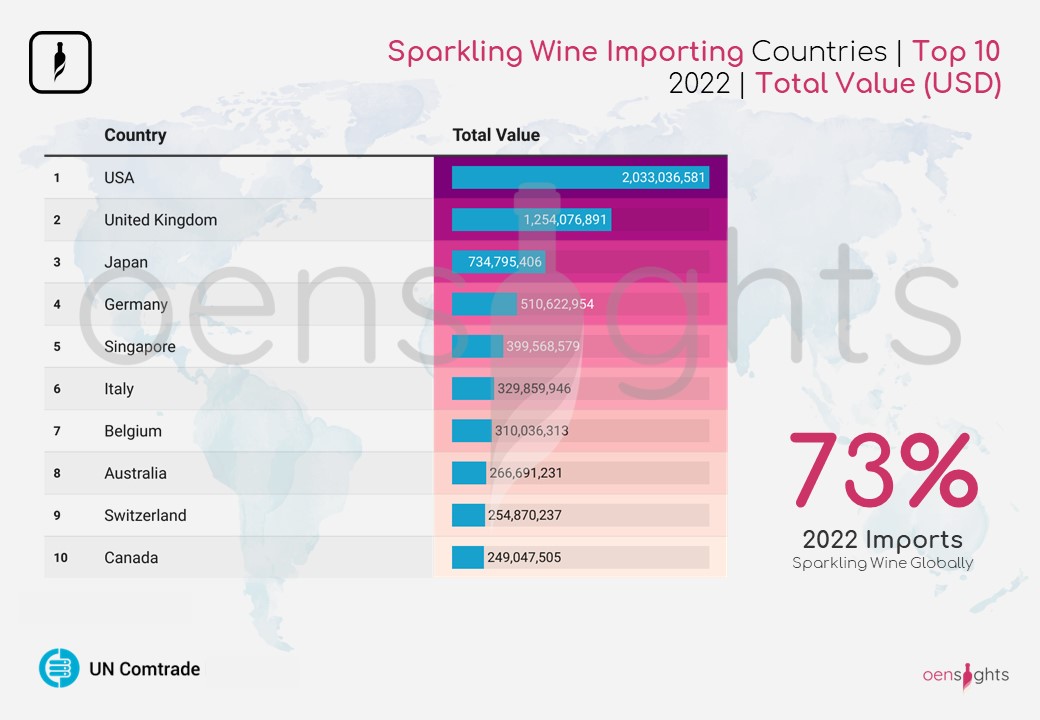

Prior to diving deeper into the 2023 information let’s review some of the key metrics of 2022, namely the top 10 countries importing sparkling wine.

It’s worth pointing out, that the top 10 countries account for roughly three quarters (73%), of the international sparkling wine Imports in terms of total value.

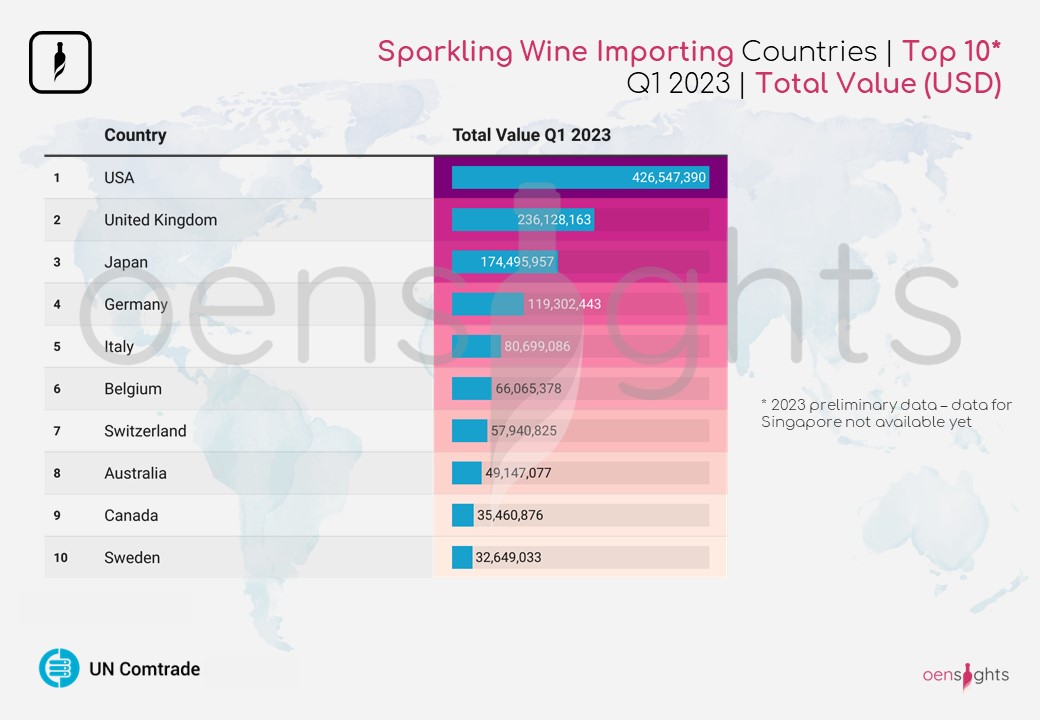

Now let’s take a look at the first quarter (January-March) of 2023. Thus far the top 10 countries for 2023 remain largely the same – it has to be noted that data are not yet available for Singapore & as such it’s not included in this analysis.

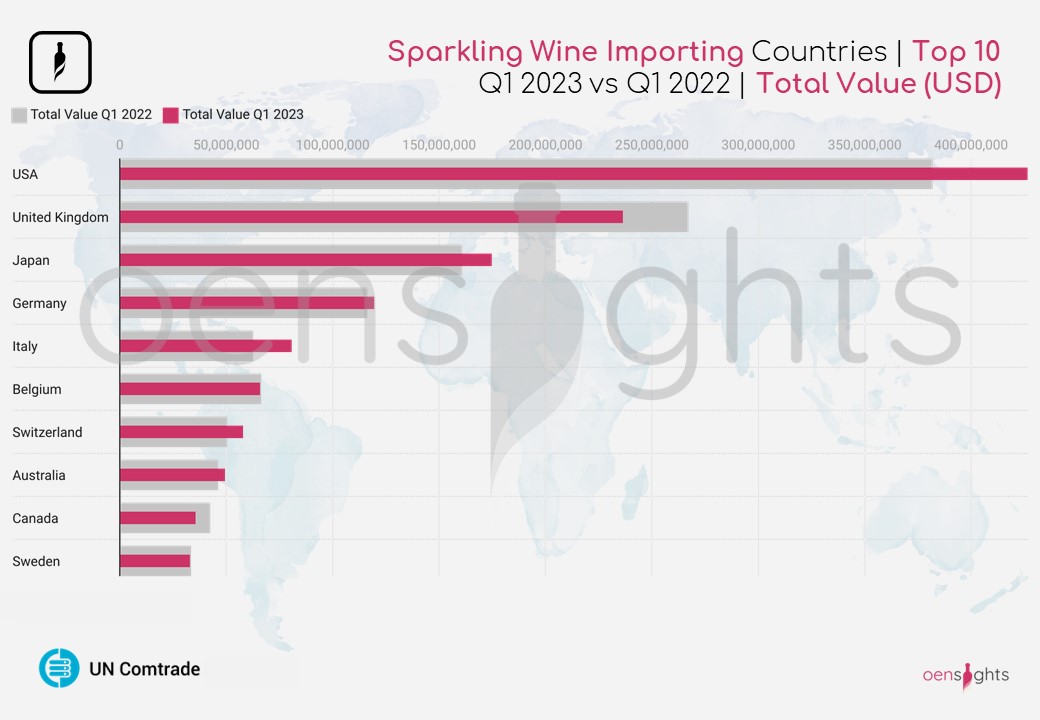

Comparing Q1 2023 with the same period in 2022, Sparkling wine imports are increasing in value in most of the top 10 countries with the exception of UK (-12%) and Canada (-17%). Negligible differences are seen in Belgium & Sweden.

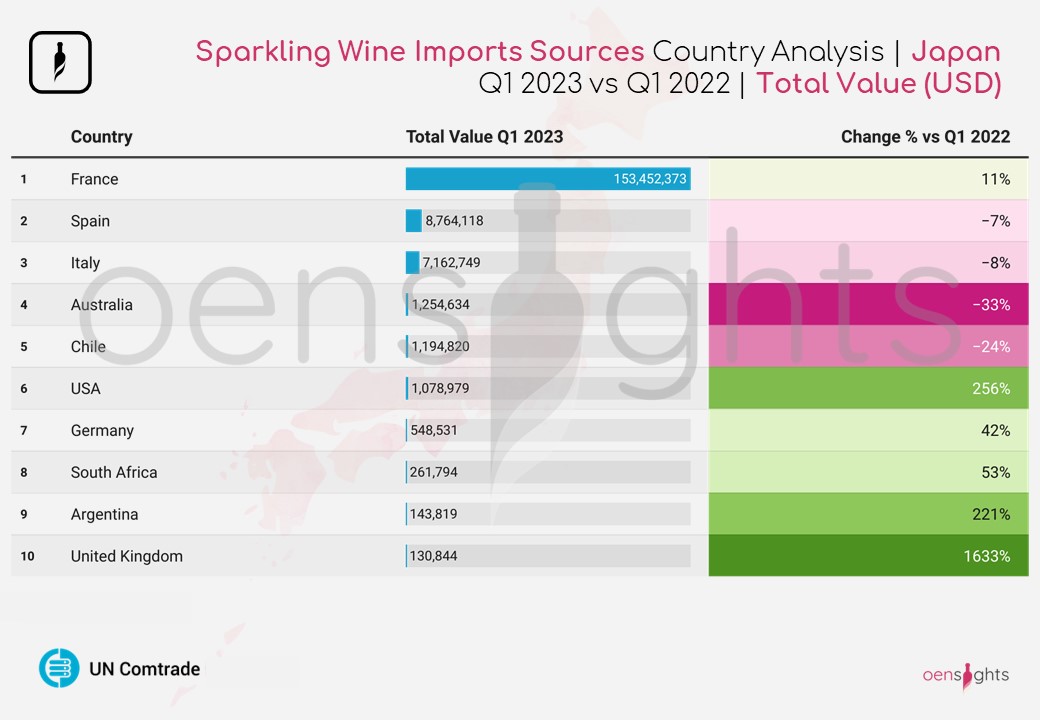

Zooming into one of the top 10 countries, let’s take a look at the “geography” of sparkling wine imports in Japan. The following diagram shows the Top 10 sources of Sparkling Wine, imported in the Japanese market in Q1 2023.

As expected, France dominates the sector with 88% of the total Sparkling Wine imports value. When combined with Spain & Italy the percentage rises to an impressive 97%! Imports from France are up 11% vs 2022 while both Spain and Italy see marginal decreases.

Other noteworthy events include imports from the UK, which see a dramatic increase (1633%!!!) to claim the 10th position, triple digits growth in Sparkling Wine from USA (256%) and Argentina (221%), while Mexico shows a rapid decline (-60%) and drops out of the top 10 compared to last year.

Stay tuned for our upcoming analysis of the first half of 2023, which will appear on glassofbubbly.com and visit https://oensights.com/ for the latest in-depth international wine trade trends & to request any custom analysis you may need for a specific market.

![]()

Elias Gagas

Digital Entrepreneur, Technology & Innovation addict. Co-founder of OENsights.com - The Digital toolkit for Wine Professionals, to harness the WineVerse, save time & money, improve their digital presence, directly engage with customers and grow their business.