Champagne Investment: Bottles Worth Collecting (and Drinking)

1st December 2025

Champagne is traditionally associated with extravagant celebrations and luxury. However, in recent decades, it has become more than just a delicious sparkling drink. Now, those in the know are choosing to invest in the most valuable sparkling wine brands, as some bottles can appreciate over time like fine wines. Wine indices began publishing in the early 2000s, and since then, the Champagne market has grown by 100%, only losing its long-time lead to Burgundy. In this article, we will discuss the most important criteria for selecting Champagne brands and highlight the most reliable ones to invest in.

When to Hold, When to Fold

In the world of online entertainment, knowing when to pause, analyse the market and make an informed decision is a skill shared by both investors and players. Just as Champagne collectors rely on expert reviews before choosing a bottle, casino players benefit from trusted sources that help them navigate bonuses, licensing, payout speeds and game selection. That’s why users searching for an online casino in Australia often turn to the independent review portal at real money online casinos for Australian players, where they receive clear, expert comparisons that make choosing a safe and profitable site much easier.

Whether you’re choosing a bottle of Dom Pérignon or an entertainment platform, the most important thing is to immerse yourself in the topic and conduct thorough research. You need to understand all the benefits and avoid investing more than you can afford, relying on your own comfort level.

The Main Tips to Consider Before Investing

Before delving into the Champagne investment, it is worth noting the key point: the famous “Champagne discussion”. It’s important to remember that Champagne is a world-famous wine region in northern France, characterised by its distinct climate. All sparkling wines produced here are called Champagne — any other sparkling wine made outside the area cannot be called Champagne. Additionally, when it comes to taste, local sparkling wines are considered the benchmark, as Champagne’s cool climate allows for the growth of high-acid grapes (Chardonnay, Pinot Noir, and Pinot Meunier). Before investing in a bottle, ensure it is produced in the Champagne region. Also, to achieve the best results, you need to consider the following essential factors:

- Vintage/Non-Vintage. Obviously, the older the bottle, the more valuable it is, just like other vintage items. There is no necessity to invest in a “young” bottle — it is not useful. Nevertheless, the exception may be only if the year could boast a plentiful harvest, and true connoisseurs exactly know that this particular batch of drink will definitely be highly valued on the market. In all other cases, for the best ROI, go for more limited vintage Champagnes.

- Producers and renown. Of course, the most profitable brands to invest in are world-renowned Louis Roederer Cristal and Dom Perignon. But now this pool is much broader — thanks to small vineyards that have begun producing significant quantities of perfect Champagne. For example, Jacques Selosse, with its microproduction, has more than doubled the cost since 2008.

- Rarity and Condition. The bottles must be stored in proper conditions to maintain all necessary features. Also, limited-edition bottles, special releases, or unique bottle sizes increase a bottle’s value due to their scarcity; for example, the 2008 Vintage Rare Brut Millesime ($175), which debuted in 1976 and has only 12 vintages.

Additionally, it is crucial to create your own investment strategy and not start with the most expensive options without prior experience in this area.

Top 5 Bottles to Collect and Invest

Recently, Champagne investment has become more popular as many businesspeople are concerned about global warming, which is already affecting the quality of new harvests. There are five bottles worth adding to the private collection with great perspectives in the future:

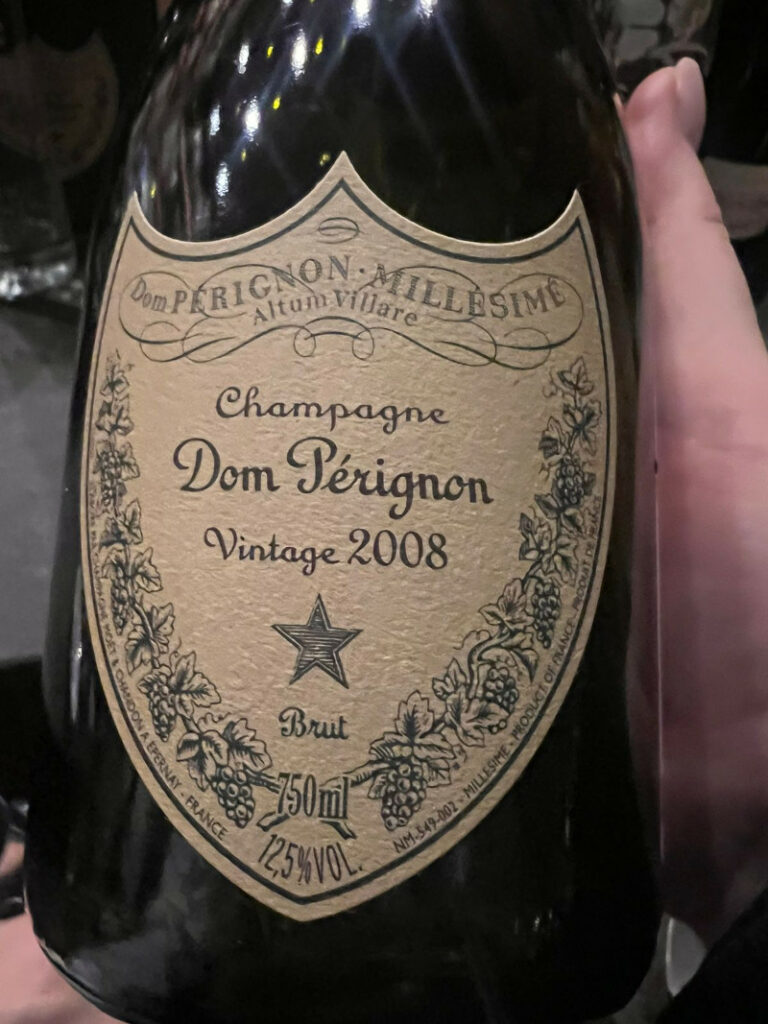

- 2008 Dom Perignon (A$375). Top vintage world-renowned brand with a great history. It is becoming increasingly popular in Asia, where interest in investing in Champagne is growing.

- 2006 Krug Vintage Brut (A$400). Rich and elegant – the price is increasing year after year.

- 2012 Louis Roederer Cristal (A$345). The price for it was the 1st certified as biodynamic, increasing by 80% over 2 years.

- 2017 Cédric Bouchard Roses de Jeanne Les Ursules Blanc de Noirs (A$320). One of those “younger” bottles, which is worth collecting as Bouchard produces their single-vineyard, single-variety, single-vintage, zero-dosage sparkling wines in limited quantities. That makes them so popular and rare.

- 2009 Jacques Selosse Grand Cru Extra Brut Millésime (A$1,800). As previously mentioned, micro-production turns these bottles into rare diamonds in the Champagne world, which is why they are so expensive.

Of course, the world of Champagne wines is richer than these options, but they are an excellent starting point.

![]()

Glass of Bubbly Content

Content shared by this account is either news shared free by third parties or advertising content from third parties and affiliations. Please be advised that links to third party websites are not endorsed by Glass of Bubbly Ltd - Please do your own research before committing to any third party business promoted on our website.